Placing the personal ownership of your assets in a Trust or Limited Liability Corporation (LLC) has become increasingly popular among high net worth individuals and families.

In fact, studies show that the number of properties owned by trusts or LLC’s has increased about 35% since 1983. This wealth management and estate planning strategy has proven to be beneficial for privacy, tax, and liability purposes. It also facilitates the transfer of assets between generations and individuals.

However, most people tend to forget about their insurance after changing ownership to a trust or an LLC.

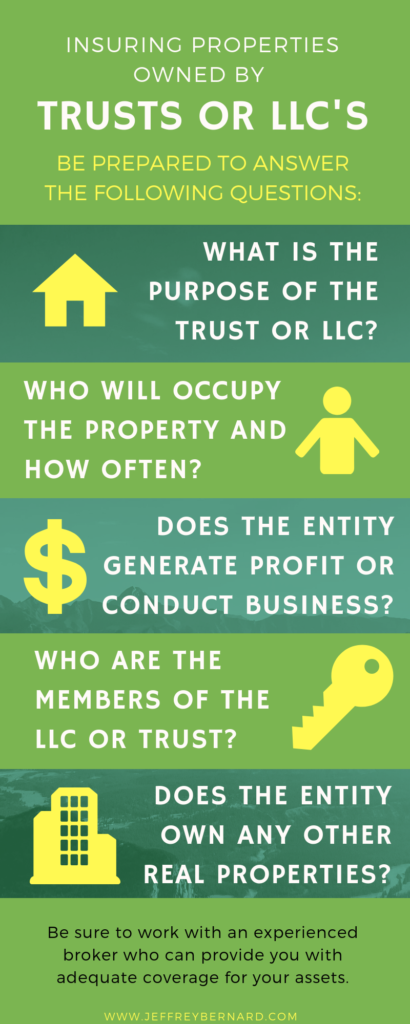

Below are 3 things to consider when transferring ownership of assets to a Trust or LLC:

1. MAKE SURE YOU HAVE ADEQUATE COVERAGE

The process of changing the ownership of your assets to a trust or LLC is also the perfect time to review all your insurance policies to confirm sufficient protection.

While some companies may offer special coverage by endorsement that specifically protects the beneficiaries or members of your LLC or Trust, it’s not a guarantee and should be checked.

2. NAME THE ENTITY AS AN INSURED OR ADDITIONAL INSURED

In the event of a claim, settlements are made payable to those named insured or additionally insured on the policy. If an entity owns your property, it has insurable interest. However, if it is not named on your policy, then the company cannot cut a check for your claim. See where this could pose an issue?

Different carriers have different guidelines, therefore makes sure all the proper names are listed to avoid any issues down the road with your insurance provider.

3. PURCHASE EXCESS LIABILITY

An Excess Liability or an Umbrella policy will offer additional protection over your existing insurance policies. Since the ultimate goal of your wealth management strategy is to protect and grow your assets, it’s important that you consider appropriate limits of liability when purchasing the coverage. (Source: https://parkpl.co/phoenix)

Excess Liability is a must for those Trusts or LLC’s which own multiple properties or assets.

Trusts and LLC’s need protection just like your other assets. Insurance should be a part of your overall financial strategy. Establishing open communication between your legal advisor, accountant & insurance broker is often the most effective method to ensuring the right insurance solution. The lawyers for estate planning located in Hopkinsville can help with the legalities of any case or dealing with the basic legalities of making a deal.

Opinions expressed in this article are solely the author’s opinion, not intended to provide the reader with legal or any other professional advice. Should you need advice or opinion, consult with a qualified professional to address your specific needs.