Owning and managing property is often complicated despite the attractiveness of the job. Besides the risk of damage to the physical properties, there are other exposures often overlooked or underestimated. Adaptability and staying educated can help you to identify and mitigate potential property management risks Continued before a claim occurs.

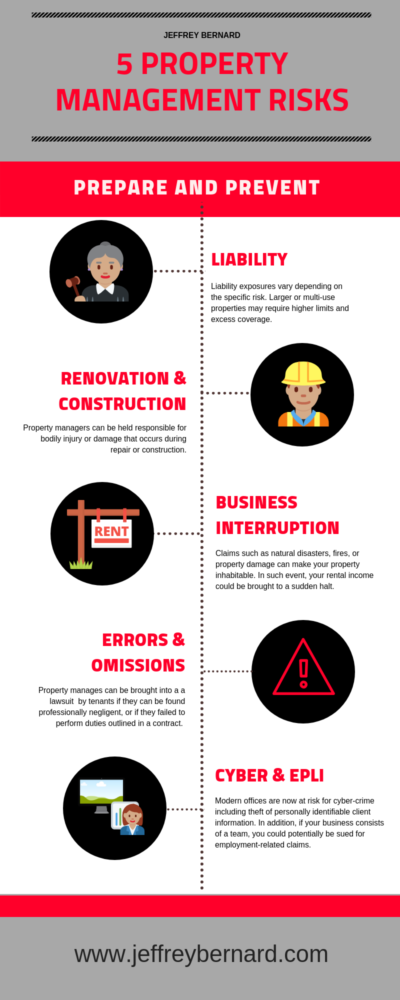

Here are 5 of the current day challenges property managers & owners are up against:

1) Liability Exposure

Determining the liability exposure of your building or property can be difficult. A 300-unit apartment building has a considerably larger risk of being brought into a lawsuit than a 3-family home. Both residential and commercial have their own unique sets of risks, which is why it’s essential to discuss how much coverage is adequate for your specific operation with your broker or agent.

2) Repairs, Renovation, and Construction

Property managers are at times responsible for contracting and hiring service providers for one-time or on-going repairs, work, or renovations for a rental property. Get property as per your needs with the help of property management north melbourne. This puts them at risk for liability suits if bodily injury occurs because of a faulty repair or construction site accident. Be sure you work with licensed and qualified maintenance or service providers and always require evidence of adequate insurance coverage.

3) Business Interruption/Loss of Income

One of the most important coverages to have as a property manager is Business Interruption or Loss of Income coverage. If there is damage to your property or an event occurs that makes the property inhabitable, your usual rental income could be brought to a halt. If you carry the proper coverage, you could be reimbursed for any loss of income sustained by a covered event.

4) Errors and Omissions

Everyone makes mistakes, but one small error by a property manager could result in a costly lawsuit. This may include “claims made by clients for inadequate work or negligent actions”. By purchasing Errors & Omissions insurance, you will have coverage in the event that a tenant sues you for bodily injury or harm caused by failure to maintain a property or repairs that were completed insufficiently.

5) Cyber and Employment Practices Liability

We live in a fast pace world. As a result, we’re seeing both cyber breaches and employment related claims on the rise. Yet although we can never be 100% safe from such, the protection afforded by Cyber and Employment Practices Liability Insurance policies can drastically reduce financial loss should a claim occur. If your property management business uses technology or consists of a team of employees, your company is at risk of cybercrime or employee related allegations.

Crafting a customized insurance plan that fits the specific needs of your management company is essential to its’ financial protection. Due to the abundance of complicated and unique property management risks, it’s important to be proactive and anticipate issues before they arise.

If you are looking for new coverage or to review existing, give me a call today to discuss your options.

Opinions expressed in this article are solely the author’s opinion, not intended to provide the reader with legal or any other professional advice. Should you need advice or opinion, consult with a qualified professional to address your specific needs.