In cyber liability insurance, businesses and organizations are protected from financial losses related to data breaches, cyber-attacks, and other forms of cyber crimes.

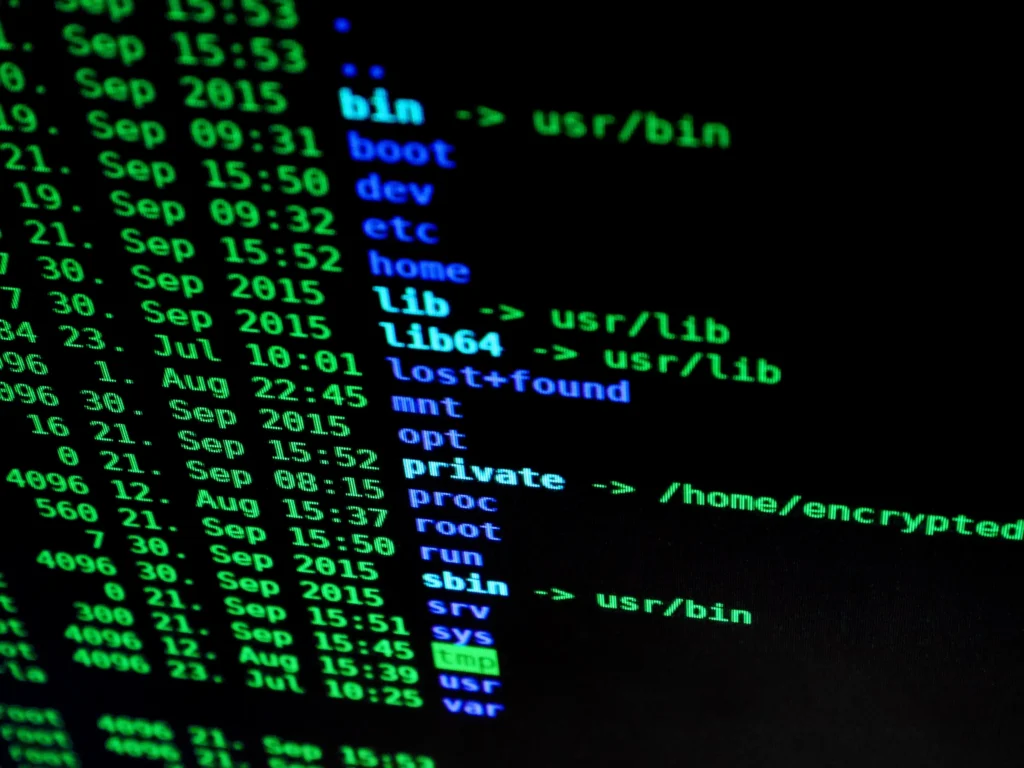

Many companies, big or small, utilize IT services to make specific tasks and processes more manageable. While it’s highly effective, it’s not always safe because there’s always a risk of being under attack by hackers and cybercriminals.

That’s where cyber liability insurance comes in.

Nowadays, with the sudden increase in the number of companies being targeted by hackers (like what happened to LastPass), being insured has become an absolute need for businesses.

Today you will learn what cyber liability insurance is, how it works, and what cases allow for coverage or not.

Understanding Cyber Liability Insurance

Cyber liability insurance is a form of insurance that protects you against possible cyber attacks.

It pays for damages that a cyber attack could cause. This includes, but is not limited to:

- Losses due to cyber extortion

- Ransom

- Theft.

Additionally, it can also pay for losses due to mistakes in data, purposely false or fraudulent claims, or even third-party claims.

The risks of not having insurance are many, but you can get one easily by talking to a broker.

What Businesses Need This Type Of Insurance?

If you own a business that gathers, stores, or processes personal or financial info from users, then you might be a possible target of a cyber attack.

These attacks damage business reputation and credibility.

If you happen to hold this type of info, then you require this type of insurance.

If you’re not sure if you do use this type of info of users, then consider asking yourself or your team these questions:

- Do we collect any personal information from our users (names, addresses, or contact information)?

- Do we collect any financial information from our users (credit card numbers, bank account info, etc)?

- Do we process any personal or financial information as part of our business operations?

- Do we share any personal or financial information with third-parties?

- Are we required to comply with any data protection laws or regulations (GDPR or CCPA)?

Now, you should bear in mind there are multiples types of this insurance.

What Are the Types of Cyber Liability Insurance?

There are two main types: first-party coverage and third-party coverage.

First-party coverage protects your business from losses that directly affect you, such as loss of income or data recovery costs.

Third-party coverage protects your business from claims made by others, such as customers or partners, who were affected by the breach.

What’s Covered by Cyber Liability Insurance?

Cyber liability insurance usually covers most of the damages caused by cyberattacks, including:

1- Data Restoration

Data restoration covers the costs of rebuilding or restoring your data.

If your system is under attack by malware, such as ransomware, your data may be lost or corrupted. To prevent this, you may need to seek assistance from IT experts.

2- Loss of Income

Losing your data doesn’t just mean that you need to rebuild or restore it; you also need to get back to work.

If your system is attacked and you experience any downtime, you’ll most likely lose money. But if you are insured, the company will pay the cost.

3- Cyber Extortion

Even though most attacks nowadays simply steal data, others are just to make money. These include ransomware and cyber extortion, which is a threat that involves a ransom note.

This is essentially a ransom to get your data back. Some companies even pay it because the alternative is to lose their data. In this case, insurance also covers the ransom.

4- Crisis Management

One of the worst things that can happen after a cyber attack is that the incident can spiral into a PR crisis.

If a company is looking for insurance, coverage for crisis management is usually included.

This includes providing public relations services, offering advice on dealing with the public, and coordinating responses to media inquiries.

5- Notification Costs

Getting attacked by hackers may make some people nervous, especially when they think their personal information will be leaked.

This may make them question where they can get help or how they can protect themselves. Cyber liability insurance can cover the cost of notification to people who may be affected.

6- Regulatory Proceedings

Attackers are getting more and more complex.

They sometimes leave backdoors on systems to make them easier to access if they want to break back in.

If such an attack is found and the company is investigated, they can also get sued. This is where cyber liability insurance can come in to make the process easier.

7- Additional Expenses

Like any other insurance, most policies are not limited to what’s also covered by other policies.

If you are insured, it includes any additional expenses you may incur due to a cyber-attack.

What’s Not Covered by Cyber Liability Insurance?

Cyber liability insurance covers almost everything, but it’s not entirely comprehensive because there are things it won’t cover. These may include:

1- Lost Profits

It only covers the loss of profits due to technical failures. It doesn’t cover the loss of revenues or income since it’s expected that you’ll be making money.

In this case, you may need to look for business interruption insurance to cover such expenses.

2- Costs Involved In Curing Defects

Sometimes, you may need to pay for professional assistance to fix technical defects, even after a cyber attack.

This may include paying for IT experts and consulting firms to clean and maintain the system. However, costs involved in curing defects aren’t covered by this insurance because they are considered costs incurred to maintain a regular business.

3- Cyberattacks Due To Negligence

It doesn’t cover costs associated with cyberattacks due to negligence on the victim’s part. This means that it doesn’t cover data recovery costs if you can’t prove that you didn’t act quickly enough.

5- Information-Breach Liability

The laws governing data security are becoming more strict. If there’s a data breach, the company can be sued by consumers.

However, if there’s no negligence and it’s proven, the company can’t be held liable for it. In this case, a data breach doesn’t fall under cyber liability insurance because it’s a form of information-breach liability.

How To Choose A Proper Cyber Liability Insurance Policy

If you’re unsure on how to choose a liability insurance that can work for you, here are some tips.

In this section, we’ll provide some tips for choosing a proper cyber liability insurance policy.

Choose The Right Broker

An insurance broker is a gateway to getting proper cyber liability insurance. They take care of the whole process and (if they are experienced) they get you tailor-made insurance to fit your specific needs.

Now, finding a broker is a whole other deal by itself. If you’re in the NY area or near, we recommend you get a decade-long-experience broker like Jeffrey Bernard. He’s done this process multiple times and always gets the best deals for his clients without them having to do much.

If you want to do it the long (usually less effective and less safe) way when it comes to finding insurance, here are some other tips.

Assess Your Business Needs

The first step in choosing a proper cyber liability insurance policy is to assess your business needs.

Take into account the size of your business, the amount of data collected and stored, and regulatory requirements related to the industry you’re in.

Look for Comprehensive Coverage

Make sure that the policy you choose provides comprehensive coverage for both first-party and third-party damages.

First-party coverage protects your own business against losses resulting from a cyber attack, while third-party coverage protects you against claims from others.

Evaluate the Insurance Company

Look for an insurance broker with experience in providing cyber liability insurance and a solid reputation for handling claims.

Consider Additional Coverages

Depending on your business needs, you may want to consider additional coverages such as social engineering fraud coverage, data recovery expenses coverage, or cyber extortion coverage.

So… Should I Get Cyber Liability Insurance? And How?

Cyber liability insurance is one of the best ways to protect your businesses against cyberattacks’ many threats.

If you want to make sure that your business is well-protected, this is one thing you shouldn’t miss out on.

Having an experienced broker will make the whole process easier. Call someone like Jeffrey Bernard now to help you out with this.

He also offers comprehensive policies in other areas, such as homeowners’, personal liability, and term life insurance, all for affordable prices, so contact him now.